RBI's Guidelines on Digital Lending, 2022

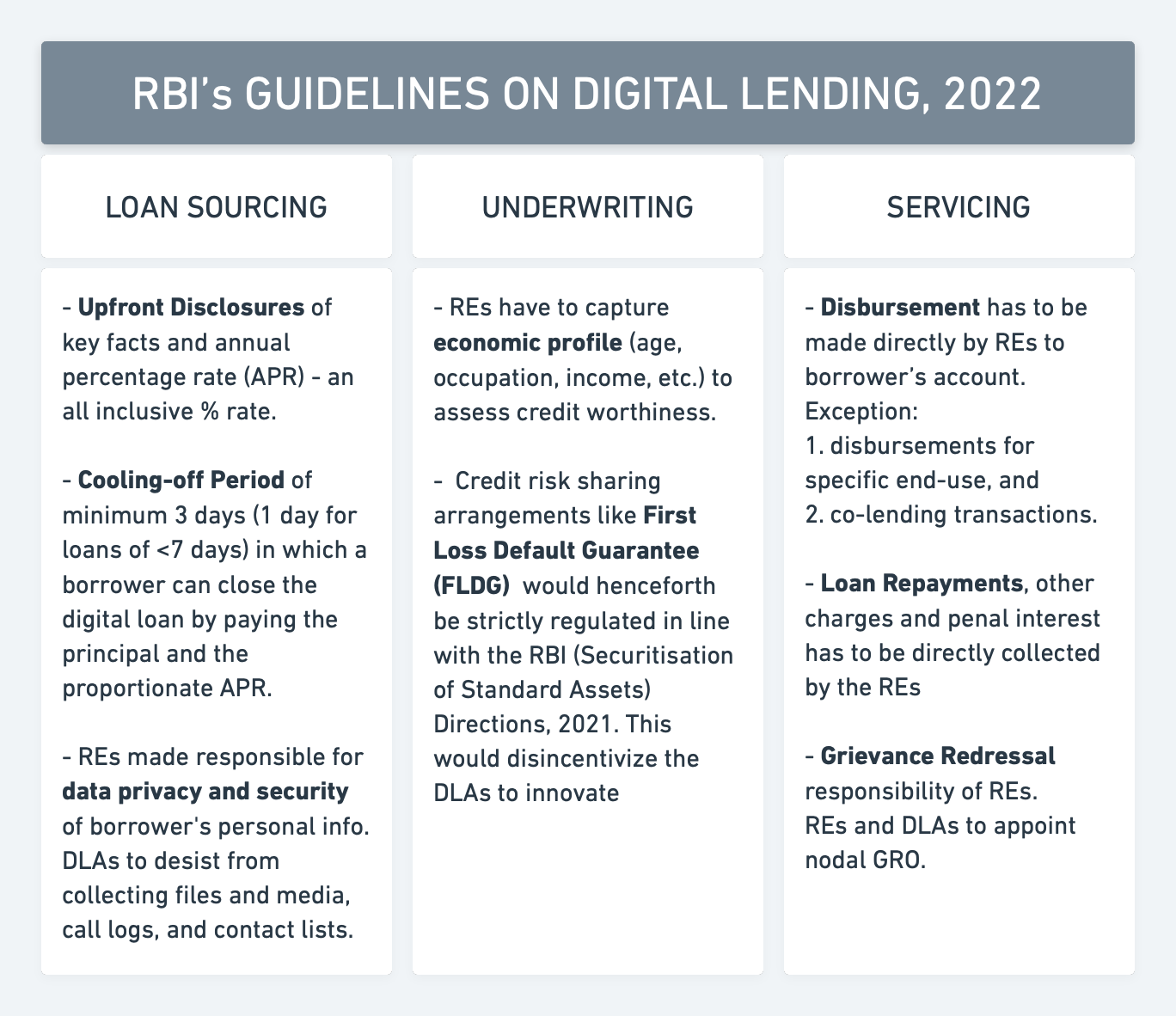

On 02nd September 2022, RBI notified the guidelines on digital lending. These guidelines are applicable to the Regulated Entities (banks, cooperative banks, NBFCs, HFCs - in short REs) in respect of their dealings with the digital lending apps/platforms(DLAs). The important takeaways from these guidelines are discussed below.

1. DISBURSEMENT has to be made directly to the borrower’s account by the REs. However, as a relief to various BNPL fintechs, disbursals for specific end-use can be directly made to the end-beneficiary. An exception is also made for co-lending transactions.

-

Loan REPAYMENTS, other charges and penal interest has to be directly collected by the REs and the DLAs cannot collect any charge/fee from the borrower.

-

Upfront DISCLOSURES of Key Fact Statement (as per form in Annex II) and Annual Percent Rate of the loan (which would reflect an all-inclusive cost of the loan including various one-time charges like processing fee but excluding contingent charges like penal charges) is mandatory. It is the responsibility of REs to share all the loan documents on the email of the borrower.

-

A COOLING-OFF PERIOD of minimum 3 days (1 day for loans having tenor of less than 7 days) **in which a borrower can close the digital loan by paying the principal and the proportionate APR.

-

REs have to capture ECONOMIC PROFILE (age, occupation, income, etc.) of the borrower so as to assess the credit worthiness.

6. GRIEVANCE REDRESSAL. Banks and their digital lending partners need to appoint one nodal grievance redressal officer and it is the responsibility of the banks/NBFCs to resolve the grievances. If grievance is not resolved within 30 days, the complaint can be escalated to the Ombudsman.

7. DATA COLLECTION. Digital Lendings apps have been asked to desist from collecting files and media, call logs, and contact lists. It is the responsibility of banks/NBFCs to ensure data privacy and security of borrower’s personal information.

- Credit risk sharing arrangements like FIRST LOSS DEFAULT GUARANTEE would henceforth be strictly regulated. There is a lack of clarity on this but in our opinion, only unregulated entities have been stopped from issuing credit guarantees for such arrangements. The same appears to be in line with the RBI (Securitisation of Standard Assets) Directions, 2021.

APPLICABILITY:

The guidelines would become applicable from the date of circular for all fresh loans. For existing loans, the compliance with these guidelines can be made by November 30,2022.

IMPLICATIONS:

- There would be increased operational as well as compliance burden on REs.

- In the entire loan cycle, the role of DLAs would become limited and they would be relegated to loan sourcing agencies with little or no incentive to innovate and optimize various processes in the loan cycle.

- Since SLAs would not be bearing any credit risk in absence of FLDG, they would be disincentivized to bring in new technology and innovation to evolve better underwriting models.

- REs would charge higher ROI in absence of FLDG, which would ultimately pass on to the borrowers. DLAs margin would also get affected.

- On a positive note, this could stop harassment of innocent borrowers from certain unregulated DLAs which have adopted unscrupulous practices for recovering loans.

•Posted on 9 September 2022

•Laws are constantly changing, either their substance or their interpretation. Even though every attempt is made to keep the information correct and updated, yet if you find some information to be wrong or dated, kindly let us know. We will acknowledge your contribution.Click here to know more.